On the 14th of November, FinTech North hosted its sixth annual Manchester Conference at Whitworth Hall, University of Manchester. As headline sponsors, we were thrilled to be part of this exciting event.

Attended by over 270 members, the day-long conference served as a spotlight on Manchester's thriving FinTech scene. With a focus on national and regional FinTech developments, the event featured keynotes from industry leaders, insightful panel discussions, and provided a vital platform for the region's innovative start-ups and scale-ups through the FinTech showcase.

The conference covered various topics, including trust in FinTech and Financial Services, Regional Innovation, Consumer Duty, and Green Finance. The central theme of the conference—trust in FinTech and financial services—resonated throughout the day, emphasising the importance of building consumer trust in the rapidly evolving financial landscape.

During the conference, Janine Hirt, CEO of Innovate Finance, provided a comprehensive update on the UK FinTech sector. She virtually joined the event to share key insights, revealing that investment in UK FinTechs reached $12.5 billion in 2022.

The data shared by Janine highlights the robust and attractive nature of the UK FinTech ecosystem. This investment not only underscores the strength of the sector but also positions the UK as a global leader in FinTech, surpassing the combined investment of the next ten European countries.

At the conference, our Regulatory Compliance Solutions Lead, Wayne Scott, presented his keynote.

Wayne's keynote emphasised a global decline in trust across various sectors such as business, education, government, and media. However, despite this, trust within financial institutions and financial services has remained relatively stable.

“We've had some huge economic shocks in the last five years. This compounds real risks and increases the potential chance for operational failure.”

Over the past five years, economic shocks such as COVID-19, inflation, energy price fluctuations, conflicts, supplier failures, and banking collapses have increased operational risks.

These economic shocks can compound real risks, creating a challenging environment for businesses. This includes disruptions to supply chains, market volatility, and increased susceptibility to operational failures, including supplier failures. As a consequence, trust in the market has declined, leading to a decrease in investment and funding.

Trust plays a crucial role in the sector. Software providers must assure customers that their business-critical applications are protected and will remain consistently available, even in the face of unforeseen disruption.

The 2023 National Risk Register now includes supplier failure (technological failure) as a potential risk. "The ramifications of supply chain failure within a systematically important financial institution would hugely damage trust within the economy, and the impacts would spread rapidly".

Recognising the wide spread impacts of these risks, it's important to assign ownership of supplier failure, service deterioration, and concentration risk so that it sits separately from cyber security and to the highest level possible. Protecting against supplier failure, service deterioration, and concentration risk is a crucial aspect of stressed exit planning. Wayne explained that we are seeing an increasing number of global regulators naming software escrow as a viable proportional component of the temporary stages of stressed exit plans.

Software escrow agreements are a critical component of the temporary stages of every successful stressed exit plan. It creates a robust foundation of a stressed exit plan, forming a legal arrangement where a third party holds the source code and other intellectual property. This information can be accessed in the event of a stressed exit, for example, supplier failure. Escrow agreements and associated verification services are one of the only ways to always guarantee the protection of business-critical information.

The second step in creating a successful stressed exit plan is knowledge transfer. This involves ensuring that all key personnel have access to the information and resources needed to continue operations in the event of a stressed exit. Following this, organisations must then subject the stressed exit plan to scenario testing to ensure it is demonstrably successful and to identify any weaknesses or areas that need improvement. The process, Wayne emphasised, allows organisations to mitigate against their own failure.

Vendors can enhance customer trust by incorporating software escrow services into their products and services. This demonstrates a commitment to ensuring business continuity and operational resilience.

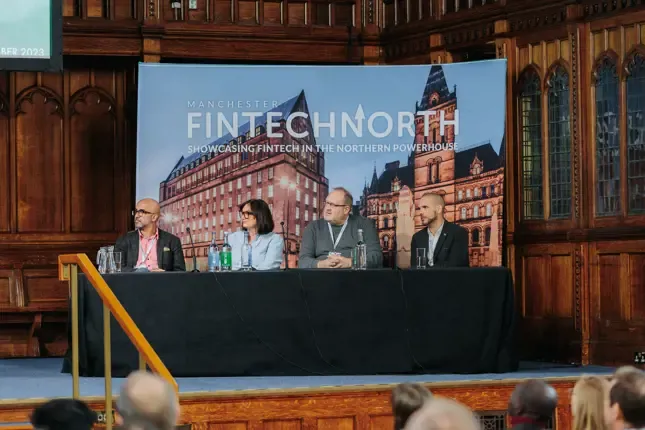

The theme of trust in FinTech and financial services is highly relevant, given the evolving nature of the financial landscape. The panel discussion, moderated by Paul Anderson, Partner at Squire Patton Boggs, delved into aspects such as consumer duty, risk, and regulatory challenges.

The panellists - Wayne Scott, Nicola Matthias from Aro, James Mackenzie from Hippo, and Sheraz Afzal from Quint—delivered a thought-provoking discussion.

"As a consumer, there is something scary about data loss"

Addressing concerns about data security and privacy is pivotal for fostering trust in FinTech. It was great to see industry experts from different fields, including regulatory compliance, risk, and legal, participating in the discussion to provide different perspectives on these issues.

Building and maintaining trust is paramount in the financial industry. FinTech companies often handle sensitive personal and financial information. Demonstrating a clear commitment to consumer duty establishes trust and credibility with users, investors, and regulatory bodies.

The day concluded with the FinTech Showcase, featuring innovative FinTech companies presenting their propositions in a lightning-style pitch format. This segment not only provided a platform for these companies to present their propositions but also highlighted the region's commitment to fostering innovation, collaboration, and growth in the financial technology sector.

The FinTech North Manchester Conference 2023 offered an immersive view of the dynamic FinTech landscape, showcasing the region’s commitment to innovation, collaboration, and growth in the financial technology sector.

As headline sponsors of this event, we were honoured to contribute to fostering collaboration and addressing crucial issues such as trust within the FinTech sector.

You can find out more about the conference here.